Written by Ethan Messeri

When President Biden signed the American Rescue Plan (ARP) into law he may have created one of the most impactful anti-poverty programs in decades: the Expanded Child Tax Credit.

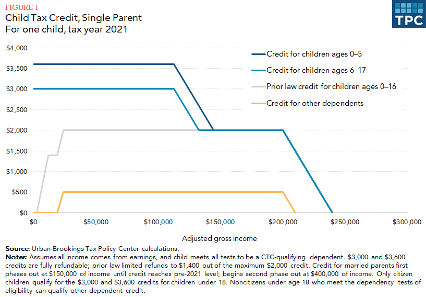

The ARP boosted the Child Tax Credit (CTC) from a maximum of $2,000 a year per child to 3,600 annually for children age 0 to 6, and $3,000 annually for children 6 to 17 (Marr, Cox, 2021). Those whose earnings were not large enough to be able to offset their taxes through the CTC and those who do not work but have children are now eligible to receive the full CTC. The image from the Tax Policy Center below displays how those earning below $50,000 did not receive the full tax credit for their child but now do. The boosted benefits gradually phase out for a single family home starting at $112,500 of annual income and return to pre-ARP levels at an income of $150,000 at $2,000 per child (Marr, Cox, 2021). The same phase-out happens for dual income families starting at $150,000 and ending at $400,000.

The expansion of the CTC will initially require more government spending. In 2019, 23 million children did not receive the full CTC because they were too poor, or their parents did not file taxes (Collyer, Harris, Wimer, 2019). Among those who were eligible, 10% received no credit. This September, the IRS sent out $15 billion to 35 million families for the CTC (Adamcyzk, 2021). Using this figure, we can estimate the CTC costs $180 billion annually which is up from $118 billion in 2019. The $180 billion figure is an underestimate, and the annual cost will continue to climb as more people sign up for the CTC and are enrolled in the IRS database. There were 1.6 million new families enrolled between July and August, so the number of families receiving the CTC should continue to rise (Adamcyzk, 2021).

Despite the increase in initial costs, the CTC will result in various long term benefits according to researchers. One study from researchers at Columbia University found that if everyone eligible was given the CTC, child poverty would fall by half from around 14% to 7.5% (Columbia University, 2021 ). While cutting child poverty is great on its own, there are many other beneficial indirect effects, such as: reduced crime, better health outcomes, increased educational attainment, and income (Marr, Huang, Sherman, 2015). The CTC tries to alleviate issues caused by poverty, by intervening early in life. Thinking about crime, children in poverty are more likely to commit violent crimes (Invest In Kids, 2020). Reducing child poverty will reduce the likelihood a child grows up to commit violent crimes. The government will save money spent on imprisoning violent crime offenders, and since there is less violent crime, neighborhoods will improve as there will be more investment into these communities. This will lead to more jobs, which will increase the collective income of the community, and as the income increases the government will have to spend less on transfer programs like TANF or Medicaid. Reducing child poverty has massive economic benefits that will ripple across the country. Crime is only one example, and more positive outcomes could be common when reducing child poverty. Another example is education. A study found that children whose parents had received benefits from the Earned Income Tax Credit and CTC had improved test scores in middle school (Manoli, Turner, 2014). Using the relationship between test scores and income, the study found that each dollar in tax credit leads to more than a dollar in adult earnings. When you factor these savings and potential growth of the tax base into the cost of the CTC, the high cost of the program price will be offset by many of the benefits.

The initial estimate of the reduction of child poverty of 50% is probably an overestimate. Not all parents will receive the CTC. Some money may be spent inappropriately ignoring a child’s need, or the CTC will create inflation. Given that a lot of the CTC was given to people who are middle class and lower income, their marginal benefit for consumption is pretty high, and they will probably spend most of their tax credit. This could cause an increase in demand for goods and services that families use, and without an increase in supply, there may be inflation that offsets some of the benefits from the CTC.

The expanded CTC was only given enough money to last until the end of 2021 (Stein, 2021). Congressional Democrats are in negationans to pass a large reconciliation bill, which includes prolonging the expanded CTC for a few more years, but one of the major sticking points is whether to add work requirements to be eligible for the CTC. According to one study this would impact 15% of children (Collyer, Harris, 2019). Those who are in favor of work requirements, see the additional requirements as a way to save money and encourage work. Proponents of work requirements believe the CTC will discourage work and reinforce the economic standing of lower income families by relying on government welfare (Doar, 2021).

First, there is not much real world evidence that the CTC will discourage work. A study using Canada’s CTC found there was minimal effect on the labor supply among parents, and a study from Columbia University found that the expanded CTC had minimal impact on employment (Baker, Massaker, Stabile). A potential theory for the lack of employment effects is that the cost annually of childcare in the United States is over $9,000 in the United States (ProCare Solutions, 2020). This means for a single mom, the marginal benefit of working is low and could be negative once they have to send their children to childcare and pay around 9,000 a year and implying no reduction in benefits will increase employment among parents.

Additionally, if there are work requirements there will be significantly more “sludge” associated with the CTCt. Sludge defined by behavioral economists is a policy that, “makes a process more difficult in order to arrive at an outcome that is not in the best interest of the sludged” (behavioraleconomics.com, 2018). In this case, the additional paperwork of proving you are working or are trying to find work will not only eliminate the people who are not working from the CTC, but sludge people who do not have the time or resources to prove they are working. Additionally, of the 7,200 childrens whose parents are not registered with the IRS only, 720,000 have been enrolled in the CTC (Bruenig, 2021). Given that most of the benefits from CTC are in reducing child poverty, adding any sludge towards lower income families will make the program less effective.

The Child Tax Credit is one of the most important federal welfare programs of recent decades. The program tries to fix the excessive means testing by other welfare programs and tries to address poverty at its root. However, whatever Congressional Democrats decide to do to the CTC in the reconciliation bill will decide if the CTC becomes just another entitlement or a key driver in antipoverty policy.

Works Cited

A Poverty Reduction Analysis of the American Family Act. Columbia University, 25 Jan. 2021, https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/600f2123fdfa730101a4426a/1611604260458/Poverty-Reduction-Analysis-American-Family-Act-CPSP-2020.pdf.

Adamczyk, Alicia. “More Children Received the Advance Child Tax Credit Payment in the Second Month.” CNBC, 13 Aug. 2021, https://www.cnbc.com/2021/08/13/more-children-receive-advance-child-tax-credit-payment-in-second-month.html.

Baker, Michael, et al. The Effects of Child Tax Benefits on Poverty and Labor Supply: Evidence from the Canada Child Benefit and Universal Child Care Benefit. Working Paper, 28556, National Bureau of Economic Research, Mar. 2021. National Bureau of Economic Research, https://doi.org/10.3386/w28556.

behavioralecon. “Sludge.” BehavioralEconomics.Com | The BE Hub, https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/sludge/. Accessed 22 Oct. 2021.

“Center on Poverty and Social Policy.” CPSP, https://www.povertycenter.columbia.edu/publication/2021/expanded-child-tax-credit-impact-on-employment. Accessed 22 Oct. 2021.

“Child Care Costs by State 2020.” Procare Solutions, 24 June 2020, https://www.procaresoftware.com/resources/child-care-costs-by-state-2020/.

Collyer, Sophie, et al. Left Behind: The One-Third of Children in Families Who Earn Too Little to Get the Full Child Tax Credit. Columbia University, Center on Poverty and Social Policy, 13 May 2019, https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/5cda0024be4e5b0001c6bdc7/1557790757313/Poverty+%26+Social+Policy+Brief_Who+Is+Left+Behind+in+the+Federal+CTC.pdf.

Cutting Crime by Cutting Child Poverty. InvestInKids.

Doar, Robert. “You’re Right, Senator Manchin: There Are No Work Requirements in Biden’s New Safety Net.” AEI.Com, American Enterprise Institute, 15 Sept. 2021, https://www.aei.org/poverty-studies/youre-right-senator-manchin-there-are-no-work-requirements-in-bidens-new-safety-net/.

“IRS Begins Sending Monthly Checks to Millions of American Parents in Crucial Test for Biden.” Washington Post. www.washingtonpost.com, https://www.washingtonpost.com/us-policy/2021/07/15/biden-child-tax-credit/. Accessed 22 Oct. 2021.

Manoli, Dayanand S., and Nicholas Turner. Cash-on-Hand & College Enrollment: Evidence from Population Tax Data and Policy Nonlinearities. Working Paper, 19836, National Bureau of Economic Research, Jan. 2014. National Bureau of Economic Research, https://doi.org/10.3386/w19836.

Marr, Chris, et al. “Recovery Package Should Permanently Include Families With Low Incomes in Full Child Tax Credit.” Center On Budget and Policy Priorities, 7 Sept. 2021, Recovery Package Should Permanently Include Families With Low Incomes in Full Child Tax Credit.

Marr, Chuck, et al. EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds . Center on Budget and Policy Priorities, 1 Oct. 2015, https://www.cbpp.org/sites/default/files/atoms/files/6-26-12tax.pdf.

Untitled. 43/Child-Tax-Credit-Expansion-on-Employment-CPSP-2021.pdf.

“What Could Have Been for the Child Benefit.” People’s Policy Project, https://www.peoplespolicyproject.org/2021/07/15/what-could-have-been-for-the-child-benefit/. Accessed 22 Oct. 2021.