By Louis Leonardi

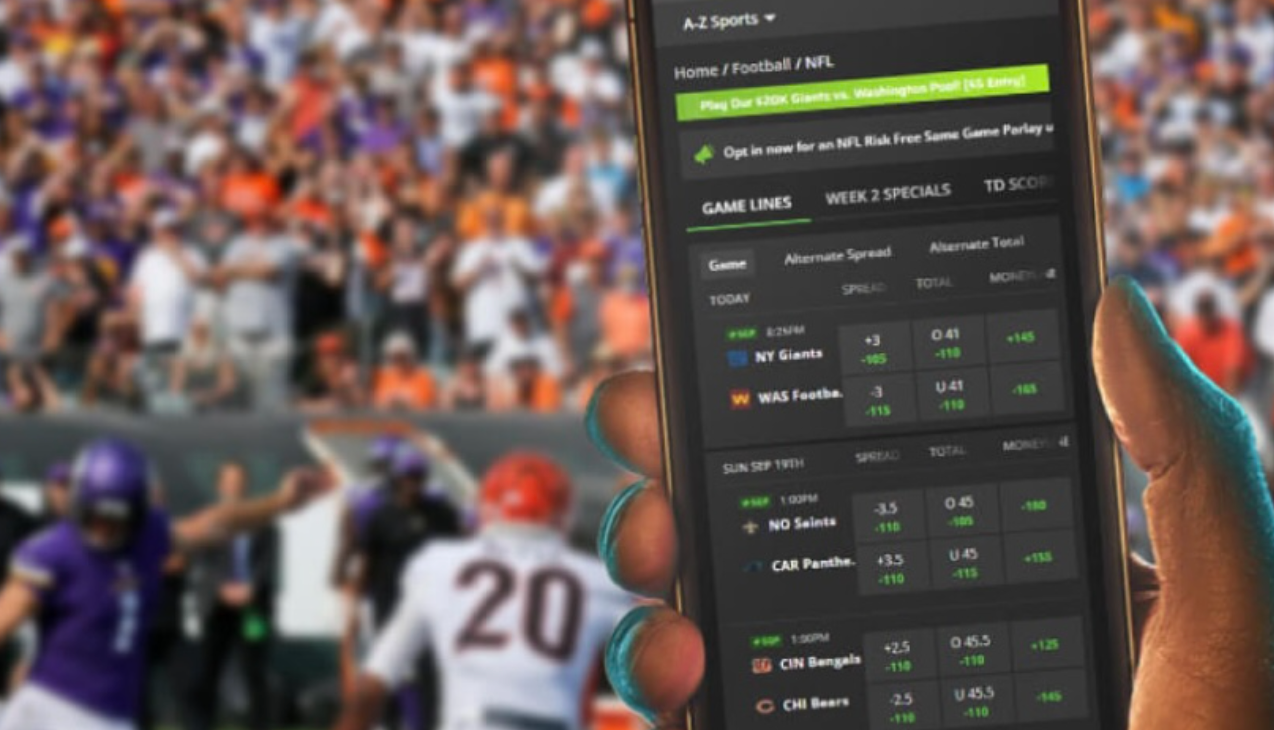

Mobile sports betting has become increasingly popular among the American public because of incentives given to bet. Winning a bet can inspire Americans to continue betting and wager more. To maximize this, the rise of online sportsbooks have made it more convenient for Americans to place bets compared to going to a Casino sportsbook. Consequently, more money generated by sportsbooks has led to more tax revenue for state governments that have legalized online sports betting. Back in 2018, the U.S. The Supreme Court ruled in favor of legalizing sports betting under the Professional and Amatuer Sports Protection Act. Since then, 31 states have approved legislation to gamble on sports. Of those 31 states, 22 of them have legalized online sports betting in the United States. By the end of 2022, more than 80% of states will have begun legislating the idea (Legal Sports Report, n.d.). Since 2018, some states such as Illinois and New Jersey have surpassed $1 billion in sportsbook taxes (Briggs 1). Given that targeting this specific industry has benefitted current states to date, the remaining 28 states in the U.S. should legislate and approve online sports gambling.

According to the Pew Research Center, 19% of U.S. adults revealed that they have bet money on sports in the past year (Gramlich l). This statistic demonstrates the American public’s growing interest market. With the growth of the sports betting market, state governments have used the opportunity to tax sportsbooks. Online sports betting provides benefits to the state government through tax revenue that improves conditions of society. By implementing a new market into a state that can be taxed, the government can increase their revenue without increasing state taxes on their people. This tax revenue has been used by state governments for their general funds, social services, schooling, or statewide projects. In addition to this, the U.S. federal government has enhanced funding to social security and medicare. The tax revenue generated from sports betting has given state and federal governments larger budgets to distribute from.

The tax revenue generated from online sports betting has and will continue to expand the budgets of state and federal governments. The current federal income tax rate on sportsbooks is 24% (Gramlich 2022). In 2022, the United States government generated approximatelty $953 million in tax revenue from online sportsbooks through October (Altruda 2). This amount marks continuing growth in the market as tax revenue has increased annually in the sports betting market. Compared to the $4.8 trillion accumulated in tax revenue by the U.S government in 2022, tax revenue totals from online sportsbooks account for 0.1% increase in the previous total (Altruda 3). Even an increase from a monetary value as large as $4.8 billion will be instrumental in American society.

States that have legalized sports betting have benefited from tax revenue specifically on sportsbooks. Illinois is an example of a state that legalized online sports gambling. Of the $142 million the state of Illinois collected in the past year from sports wagering, online sports betting is responsible for 96% of that revenue (“The Civic Federation”, 2022). With this money, Illinois has been able to increase funding to capital projects to improve roads, transportation systems, schools and universities (Brainerd 3). Similar results have developed in other big market states with online sports betting such as New Jersey, New York, and Nevada. These states have been able to further support health and human service programs, provide tax relief to local citizens, and increase funding to state aid education (Brainerd 4). Because states with large sports markets have demonstrated successful sports gambling revenue through online sports betting, other states with big markets like Florida, California, and Texas should promote and legalize online sports betting.

In the two years online sports wagering statistics have been available, it is responsible for almost two-thirds of overall handle, amount of money wagered during that period (“Sportshandle” 2). The online sports betting market should only continue to expand over the next decade. Although tax revenue reap larger sums for large sports market states, smaller market states have experienced levels of success that have helped improve their economic situations. For example, despite having any professional sports teams and having a low population, Iowa has managed to expand the state’s monthly handle of online sports bet since 2019. With 90% of Iowa’s sports bets being placed online in 2022, Iowa accumulated a record-breaking $8 million in tax revenue off of sportsbooks (Altruda 4). This money was sent for the use of Iowa’s general assembly, responsible for funding higher education in the state (Brainerd 4). Other states with low populations should allow online sports betting as a result of Iowa’s benefits. Given that the main market in these states are agricultural, implementing a new market into the state diversifies its economy. Being a smaller state with little sports activity, Iowa’s financial benefits demonstrate that online sports betting has positive effects on both large and small market states.

The movement to legalize online sports betting in other U.S. states has proven to have positive ramifications in the 22 states with legalized online sports gambling. Both large market and small market states have increased tax revenues and have been able to expand state budgets because of online sportsbooks. The increasing annual sports handle results prove that this market is only growing. The only remaining concern will be if states are willing to get with the times to increase financial benefits in a growing market.

Work Cited

Brainerd, J. (2021, March 1). The Early Bets Are In: Is Sports Betting Paying Off?. National

Conference of State Legislatures.

https://www.ncsl.org/research/fiscal-policy/the-early-bets-are-in-is-sports-betting-paying-

off.aspx

Briggs, D. (2022, September 16). Sports Betting Revenue In Illinois Surpasses $1 Billion. Play

Illinois. https://www.playillinois.com/july-2022-il-sports-betting-revenue-report/

Gramlich, J. (2022, September 14). As more states legalize the practice, 19% of U.S. adults say

They have bet money on sports in the past year. Pew Research Center.

https://www.pewresearch.org/fact-tank/2022/09/14/as-more-states-legalize-the-practice-1

9-of-u-s-adults-say-they-have-bet-money-on-sports-in-the-past-year/

Legal Sports Report. (2022, September 1). Where is Sports Betting Legal – All 50 States Covered

[date format=”Y”]. https://www.legalsportsreport.com/sportsbetting-bill-tracker/

SportsHandle. (2022, October 26). Legal US Sports Betting Revenue, Handle And State Tax

Database. https://sportshandle.com/sports-betting-revenue/

State of Illinois Collected $1.9 Billion in Gaming Revenue in FY2022. (n.d.). The Civic

Federation. Retrieved October 27, 2022, from https://www.civicfed.org/civic-federation/blog/state-illinois-collected-19-billion-gaming-revenue-fy2022