Written by Lakshay Sood China’s economy has expanded over twenty years, becoming the second-largest, with a nominal GDP of $18.46 trillion in 2023 (IMF estimate). China’s rapid economic growth has helped its citizens escape poverty. It has become more economically and strategically ambitious globally. Beijing’s Belt and Road Initiative (BRI) reflects the country’s growing global…

Category: International Economics

Inequality, Carbon Emission, and the Future of Climate Change Mitigation

Written by Lily Liang We all contribute to climate change, but not to the same extent. Between 1990 and 2015, the world’s richest 10% were responsible for more than half of the carbon dioxide emitted to the atmosphere and used up one third of the world’s remaining 1.5C carbon budget (Watts, 2023). Today’s global carbon…

Javier Milei to take on Argentina’s Economic Crisis

Written by Gabi Breuer In late October, Argentina held presidential elections, crucial in determining how the country would handle its economic turmoil. Since the nineties, Argentina has struggled with such hardships: having substantial debts, falling into deep recession periods, and facing extraordinary inflation. This most recent election was critical to ensure Argentinians were put on…

A Divided East and West

Written by Amanda Katiraei In November 2023, Chinese factories confronted overcapacity and a struggling domestic economy by boosting exports. These actions to boost their economy have created new trade tensions, particularly in industries like electric vehicles and solar panels. As manufacturers are now facing weakened domestic demand, they are aggressively cutting prices to gain traction…

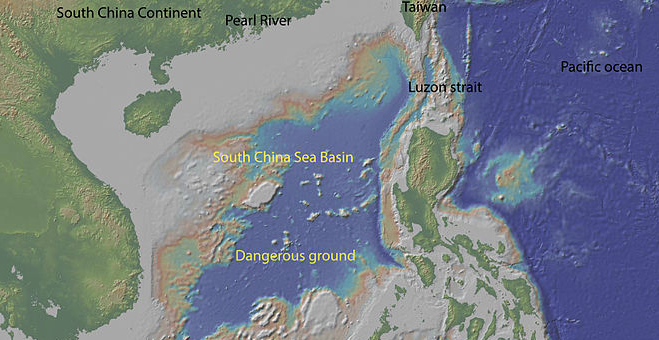

Showdown in the Spratleys: How Economics Drives China’s Claims in the South China Sea

Written by Lizzy Cohn Over the last century, territorial claims in the South China Sea, specifically the Spratly Islands, have been widely disputed among many countries including China, the Philippines, Vietnam, and Japan. In addition to these islands being a prime location along the major commercial shipping routes to northeastern Asia, they are extremely rich…

Op-ed: How ECO Compares to Other Economic Alliances Such as the EU

Written by Bartu Geyik Uzbekistan has recently hosted the Economic Cooperation Organization (ECO) Summit of 2023, uniting many countries from West to South Asia. This economic cooperation has been ongoing for the past four decades, reaching 10 members during 1992 after the ex-soviet Central Asian countries joined the cooperation. The world is becoming multipolar, evidenced…

The Electric Vehicle Industry: A Background of BYD, China’s #1 Automaker

Written by Avril Yu Amidst forecasts of a future troubled by a climate change crisis and diminishing gasoline supply, the electric vehicle shines: it’s thought of as a newfangled, science fiction illustration—perhaps even a little presumptuous, in its youth and its ideals. If the electric vehicle seems that way even today, then the uncertainty surrounding…

Threats facing European Higher Education Today

Written by Christian Lewandowski Two narratives have featured prominently in European policy debates of the past several decades within the context of higher education: the knowledge society and European integration narratives (Curaj et al., 2015). The knowledge society narrative, one of the most dominant narratives in policy debates globally, is concerned with the role the…

Trade Wars and Tariffs: What Roles Does the US Play?

Written by May Thet Naing The Boston Tea Party (1773), The Chicken War (1962), and The Banana Wars (1993) are all unique-sounding names for historical trade wars that, to some extent, relate to the conditions of the modern international economy, particularly to the rise of the US-China trade wars. What do all these trade wars…

Chained Together: Global Supply Chains & the Pandemic

Written by Tarini Sathe The global Coronavirus outbreak highlighted many problems with various systems and institutions on different scales; one of the biggest problems it exposed was the weakness of supply chains across global industries. A supply chain is a network of entities or stakeholders involved in the production process of a good; the chain…